The New York Times Company announced fourth quarter 2020 financial results today. Operating profit increased to $80.5 million in Q4 2020 from $78.0 million in the same period of 2019. Adjusted operating profit increased to $97.7 million from $96.3 million in the prior year, as higher digital-only subscription revenues more than offset lower advertising and other revenues.

Subscriptions Are Key

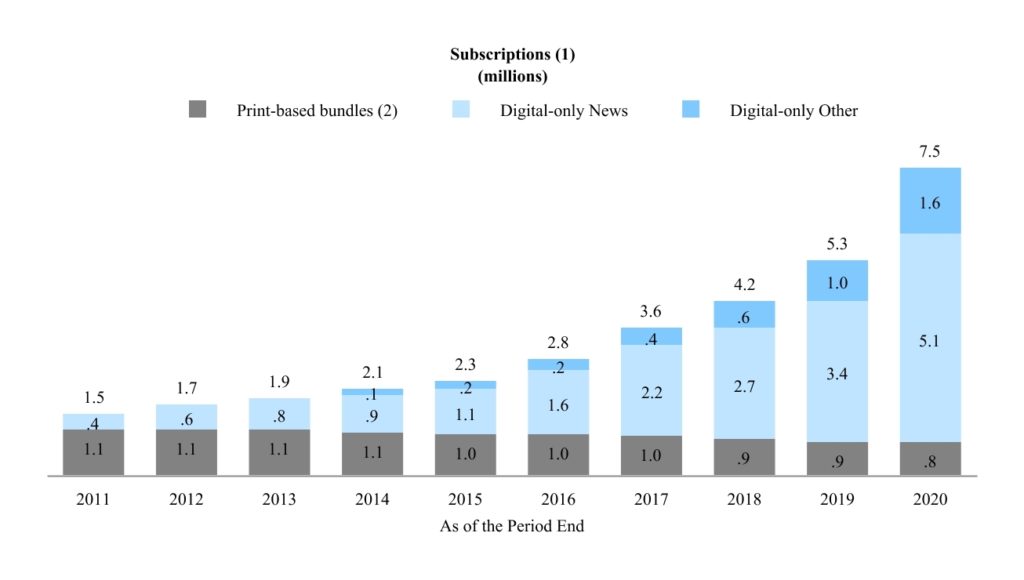

Meredith Kopit Levien, president and chief executive officer of The New York Times Company pointed at subscription additions. The full year of 2020 saw a record 2.3 million net new digital-only subscriptions added. Q4 2020 saw 627,000 total net subscription additions (425,000 to the news product). The Times had 7.5 million total subscriptions across digital and print products at the end of 2020.

“Digital First And Subscription First Company”

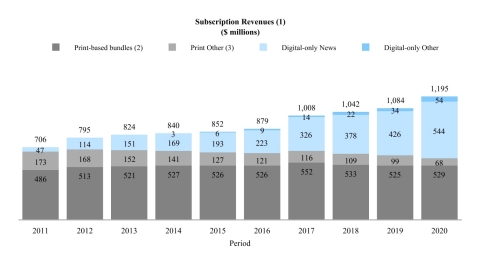

Levien said the Times had reached two “key milestones”. First, digital revenue overtook print for the first time. Secondly, digital subscription revenue is now their largest. Digital subscriptions have been the fastest growing revenue stream for awhile.

The Times now wants to scale on the idea that people will pay for quality journalism. “With a billion people reading digital news, and an expected 100 million willing to pay for it in English, it’s not hard to imagine that, over time, The Times’s subscriber base could be substantially larger than where we are today,” according to Levien.

Podcasts

Levien reported $36 million in podcast revenue in 2020- up $7 million in the prior year. The Times expects podcast revenue growth to be strong for The Daily and other shows. The acquisition of The Serial podcast should be a positive for revenue as well.

Revenue Highlights

- Total revenues for the fourth quarter of 2020 increased 0.2 percent to $509.4 million from $508.4 million in the fourth quarter of 2019.

- Subscription revenues increased 14.7 percent to $315.8 million.

- Revenue from digital-only products increased 36.8 percent, to $167.0 million.

- Print subscription revenues decreased 2.9 percent to $148.8 million, largely due to lower retail newsstand revenue, while revenue from the Times’s domestic home delivery subscription products grew 2.2 percent.

- Advertising revenues decreased 18.7 percent to $139.3 million.

- Fourth-quarter 2020 digital advertising revenue decreased 2.3 percent, while print advertising revenue decreased 37.9 percent.

- Digital advertising revenue decreased primarily as a result of lower creative services revenues, which were partially offset by higher direct-sold and open market programmatic advertising. Print advertising revenue decreased as the COVID-19 pandemic further accelerated secular trends, largely impacting the entertainment, media and luxury categories.

- Digital ad business stabilized by mid year.

- Other revenues decreased 12.1 percent to $54.3 million.

- This was primarily as a result of fewer episodes of their television series as well as lower revenues from live events and commercial printing. These declines were partially offset by higher Wirecutter affiliate referral revenues.

2021

On the call, Levien sees more growth in 2021 but news will impact subsription revenue. The extraordinary events of the past 12 months show that it is hard to predict what will be drive news in the new year.

They’ll invest in the their 1,700 strong newsroom in the coming year. Digital products will continue to be added. This will make their journalism even more engaging and impactful.

“News adjacent” products like Cooking and Games will continue to be invested in. All of these products will make the Times even more part of readers lives. And make the brand more powerful.