Tribune Publishing Company announces that a special committee of its Board of Directors deems an April 1 “revised, non-binding proposal from Newslight, LLC” to acquire all outstanding shares or Tribune stock for $18.50 per share would “reasonably be expected to lead to” a “Superior Proposal” as defined in Tribune’s merger agreement with Alden Global Capital. Furthermore, Tribune states that Newslight’s proposal is “fully financed” by equity commitments from Bainum and Wyss. However, their proposal remains subject to “completion of due diligence and negotiation of definitive documentation.”

Newslight is an entity owned by Stewart Bainum and Hansjörg Wyss. Stewart Bainum is chairman of Maryland based Choice Hotels. Hansjörg Wyss is a Swiss billioniare who lives in Wyoming. He is worth $6 billion, according to Forbes.

Why the “Superior Proposal” Designation is Important

This determination that the Newslight proposal is “Superior” means that Tribune can now engage in discussions and negotiations, and provide diligence information to, Newslight. However, it doesn’t allow Tribune to terminate the Alden merger agreement. Additionally, it doesn’t allow Tribune to enter into any agreement with Newslight.

The Alden Agreement

A quick brief on how we got here- on February 16, 2021, Tribune and Alden announced a merger agreement. This agreement would allow Alden to acquire all of the outstanding shares of Tribune stock, not currently owned by Alden, for $17.25 per share in cash.

Alden currently owns 11,554,306 shares of Tribune common stock, representing 31.6% of the Company’s outstanding shares.

This agreement is still in “full force and effect”. The Tribune Board hasn’t determined the Newslight proposal is in fact a “Superior Proposal”. Therefore, the Board still recommends stockholders vote in favor of the Alden Merger Agreement.

What’s Next

The Tribune Board’s special committee, with its legal and financial advisors, will weigh the “outcome of its discussions with Newslight and its principals in order to determine the course of action that is in the best interest of Tribune and its stockholders.” Tribune warns that there is no assurance that discussions with Newslight will result in binding proposal.

The Chicago Tribune reports that sources say “If a deal is consummated, the long-term plan is for Bainum to own the Baltimore Sun, Wyss to own the Chicago Tribune, and to sell off the rest of the Tribune Publishing newspapers to individual or group owners.”

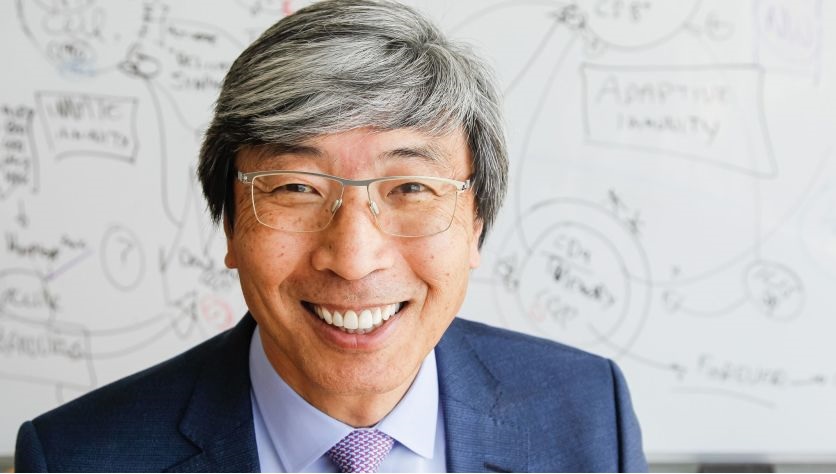

Key Figure

Los Angeles Times owner Dr. Patrick Soon-Shiong still holds a powerful set of cards as he controls 25% of Tribune stock.

Dr. Soon-Shiong hasn’t commented on Bainum’s plan, but did say last month that “newspapers are important to the community.” That was in response to a Wall Street Journal report that he was trying to unload the newspapers he owns, The Los Angeles Times and San Diego Union-Tribune.

Given Dr. Soon-Shiong’s experience trying to turn around The Los Angeles Times, the idea of a Chicago Tribune or Baltimore Sun going it alone raises questions. But if Bainum and Wyss are willing to fund the projects for the long term, anything is possible. The Alden proposal would do the opposite, with the Tribune titles becoming part of Alden’s MediaNewsGroup.