In proxy materials filed April 14, Tribune Publishing continues to recommend shareholders apporve the Merger Proposal by Alden Global Capital.

The Special Committee of the Tribune board of directors writes, in a draft letter dated April 14, 2021, that they “determined that the terms of the Merger Agreement and the transaction contemplated by it, including the Merger, are fair to, and in the best interests of, the Company and its unaffiliated stockholders”

Stockholders are invited to virtual “Special Meeting” at time and date to be determined. Approval of the Merger Proposal requires an affirmative vote of at least two-thirds of the shares of Tribune common stock.

The Alden Agreement

A quick brief on how we got here- on February 16, 2021, Tribune and Alden announced a merger agreement. This agreement would allow Alden to acquire all of the outstanding shares of Tribune stock, not currently owned by Alden, for $17.25 per share in cash.

Alden currently owns 11,554,306 shares of Tribune common stock, representing 31.6% of the Company’s outstanding shares.

Potential U.S. Newspaper Powerhouse

Alden owns MediaNewsGroup, which operates 200 publications. Titles include the Denver Post, Mercury News, Orange County Register and Boston Herald.

Tribune, briefly known as tronc, is a media company which owns local media businesses in eight markets. Tribune newspapers include the Chicago Tribune, New York Daily News, Baltimore Sun and Orlando Sentinel.

Together, Tribune and Alden would control media properties in half of the top 10 markets in the United States. This includes the three biggest DMAs in the country, New York, Los Angeles and Chicago.

Key Vote

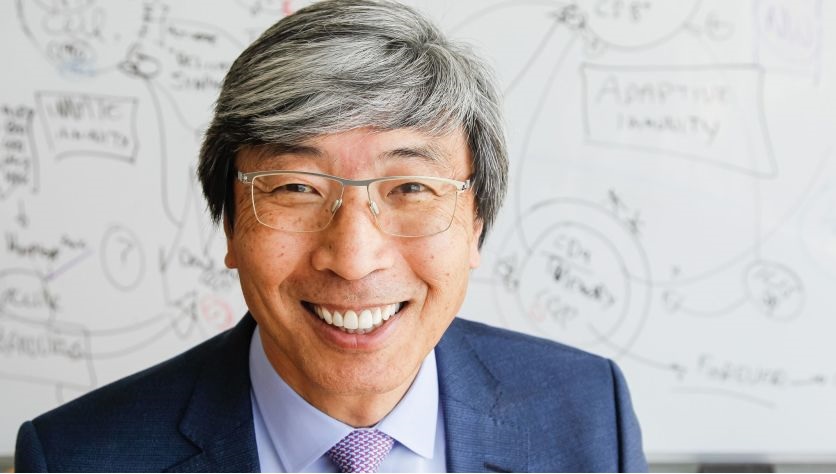

Again, the Alden-Tribune deal will need shareholder approval. Dr. Patrick Soon-Shiong will hold a powerful set of cards as he controls 25% of Tribune stock.

Dr. Soon-Shiong hasn’t commented, but did say last month that “newspapers are important to the community.” That was in response to a Wall Street Journal report that he was trying to unload the newspapers he owns, The Los Angeles Times and San Diego Union-Tribune.

According to the Tribune proxy report, Dr. Soon-Shiong had discussions with Mason Slaine regarding selling his Tribune shares to Slaine. Slaine is an existing Tribune stockholder who owned approximately 7.9% of the outstanding shares of the publishing company. However, the transaction never occurred.

The White Knights

Stewart Bainum, Chairman of Maryland based Choice Hotels

NEW YORK, NY – APRIL 01: Former Mayor of New York City Michael Bloomberg (L) and philanthropist Hansjorg Wyss attend Oceana’s 2015 New York City benefit at Four Seasons Restaurant on April 1, 2015 in New York City. (Photo by Craig Barritt/Getty Images for Oceana)

Stewart Bainum and Hansjörg Wyss have an alternative proposal. Stewart Bainum is chairman of Maryland based Choice Hotels. Hansjörg Wyss is a Swiss billioniare who lives in Wyoming. He is worth $6 billion, according to Forbes. Together, they control an entity called Newslight. They made an a proposal to acquire Tribune at a share price.

Tribune’s special committee of its Board of Directors deemed that April 1 “revised, non-binding proposal from Newslight, LLC” to acquire all outstanding shares or Tribune stock for $18.50 per share would “reasonably be expected to lead to” a “Superior Proposal” as defined in Tribune’s merger agreement with Alden Global Capital. Furthermore, Tribune states that Newslight’s proposal is “fully financed” by equity commitments from Bainum and Wyss. However, their proposal remains subject to “completion of due diligence and negotiation of definitive documentation.”

Bainum has long had interest in acquiring the Baltimore Sun, according to the Tribune Proxy Report. While Tribune couldn’t agree to financial terms earlier, Alden was open to exploring the sale of The Sun to Bainum.

On January 5, 2021, Mr. Bainum delivered a letter to the Special Committee in which he indicated “If I cannot reach an agreement with Alden on a fair value for The Sun in conjunction with their bid for Tribune, I am willing to explore with the Special Committee purchasing all of the outstanding shares of Tribune at a reasonable price that will deliver fair value to all Tribune shareholders”. Such letter did not include a proposed price for the Company.

From the Tribune Proxy Statement Report

On March 26, 2021, Mr. Bainum and Mr. Wyss sent letters to the Special Committee (the “March 26 Letters”) reiterating Mr. Bainum’s non-binding $18.50 per share offer, adding that Mr. Wyss had indicated interest in providing at least $100 million of equity financing and possibly additional loans, that Mr. Bainum did not believe any additional equity financing would be necessary, but that he continued to believe significant additional amounts would be available, and stating that Mr. Bainum had been working with Wells Fargo regarding potential debt financing.

From the Tribune Proxy Statement Report

Wyss sent an email March 30 to Lazard, Tribune’s financial advisors, stating that he would “commit all additional required financing necessary to complete the transaction.”

On a call later that day, Wyss and Bainum “confirmed their strong commitment to the potential acquisition of Tribune”. Their long term plan may involve a not-for-proft model. However, their proposal for acquisition would “involve a more customary, private, for-profit acquisition vehicle.”

An April 1 letter from Newslight reiterated their offer to acquire Tribune for $18.50 per share in cash. The two men alone would fully financed the deal. Mr Bainum committed $100 million and Wyss would put up $505.3 million. Furthermore, the pair would finance a portion with Tribune’s cash on hand (they assume $140 million vs. the $100 million assumed by Alden). The duo would arrange debt financing but this wouldn’t be a condition to close the deal.

Bidder for The Morning Call Media Group

On March 10, 2021, a bidder submitted an offer to purchase The Morning Call Media Group for $30 to $40 million. Tribune wasn’t able to pursue this due to the Merger Agreement with Alden. Therefore, they referred any such inquiries to Alden.

Why Tribune Prefers the Alden Proposal

Tribune’s Special Committee makes clear they recommend Alden’s Merger Proposal over the Newslight proposal for several reasons.

- In considering the Newslight Proposal, the Special Committee considered the fact that the proposal is nonbinding, subject to the completion of due diligence and negotiation of definitive documentation, and assumes the use of $40,000,000 more of Tribune cash than the Alden Merger Agreement.

- The Special Committee also considered that Mr. Bainum’s previously stated interest being in acquiring The Sun, rather than Tribune as a whole, and Mr. Wyss’ not having previously indicated an interest in acquiring Tribune, despite the public reports of negotiations between the Tribune and Alden starting at the end of December 2020.

- Accordingly, as of the date of Tribune’s proxy statement, there can be no assurance that discussions with Newslight will result in a binding proposal, that the Special Committee will determine that any such proposal constitutes a “Superior Proposal” as defined in the Merger Agreement or that a transaction with Newslight will be approved or consummated on any particular terms or at all.

- The Special Committee also considered the fact that any Newslight Transaction would likely not be capable of being completed as quickly as the Alden Merger, due to the earlier start that Alden has had on the required stockholder approval process for the Alden Merger, that the waiting period applicable to the Alden Merger under the Hart-Scott-Rodino Act has already expired, and that any Newslight Transaction would require more votes than the Alden Merger by stockholders other than Alden, if, as Alden has indicated, Alden does not vote its shares of Company common stock in favor of any Newslight Transaction.

- General trends in the newspapers industry such as declining newspaper buying and migration to other forms of news media would make it more difficult to survive as an independent company. Also, questions about whether resources would be available to invest in digital products, services and opportunities going it alone.

- Uncertainties with respect to Tribune’s ability to successfully transition from a print focused media company to a digital platform company. That includes it’s prospects to deliver content on platforms like Facebook, blogs, tablets, phones and Apple News.

- The Committee examined selling Tribune in pieces. However, this was risky and unlikely to lead to higher values. This is due to divestiture related tax costs, large centralized functions where were not scalable as the operation shrunk and limited number of strategic buyers with synergies. In addition, contractual liabilities remaining after a series of divestitures.