Taboola will be listed as “TBLA” on the NYSE via a merger with ION Acquisition Corp., a SPAC (special purpose acquisition company).

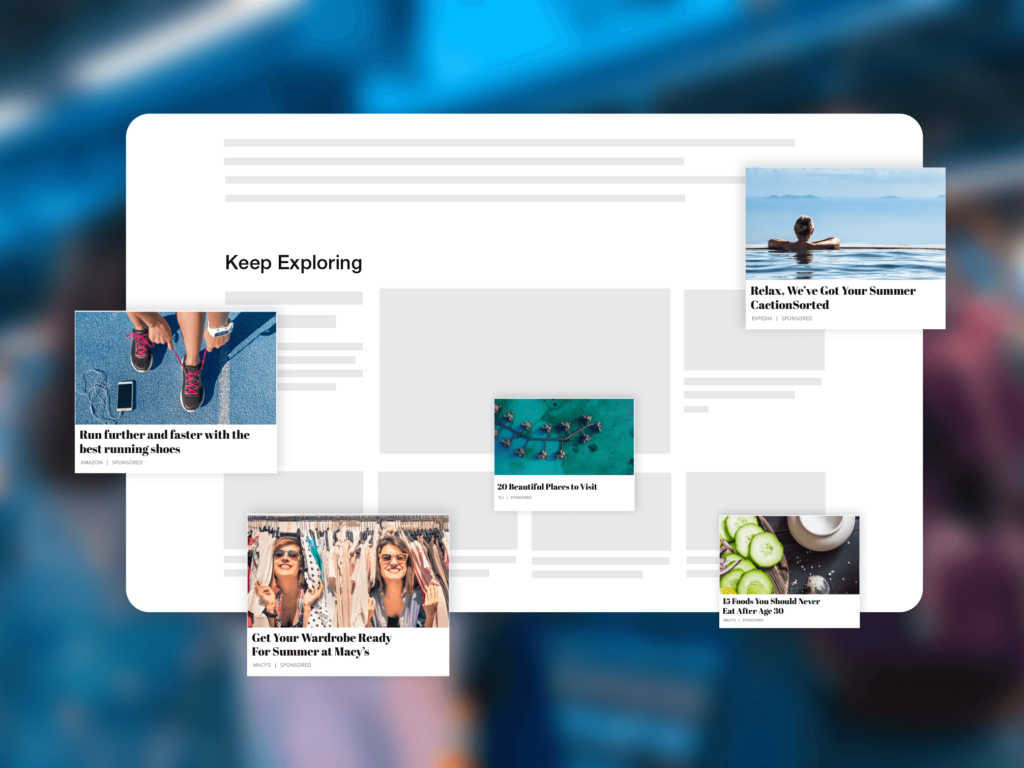

Taboola describes itself as “a global leader in powering recommendations for the open web, helping people discover things they may like.” At its core, its a recommendation engine that is able to serve up suggested content and advertising to consumers across the web.

CNBC is one of their publisher partners. A glance at the bottom of a CNBC article today serves up Taboola powered recommended ads for N95 respirator masks, content on why I should stop dribking $10 grocery store wine and “the genius hack every Home Depot shopper should know.”

That is Taboola of today. Founder and CEO of Taboola, Adam Singolda, is charting its future.

“As we move forward, there is immense opportunity for Taboola to continue to be the champion for the open web, and those who do business there. Over the next 10 years I see Taboola growing to power recommendations for anything, such as eCommerce, games, applications, and I see those recommendations everywhere, on every device. They will live on our connected TVs at home, recommending shows people love, as well as in people’s cars surfacing content they love, podcasts, and text-to-audio from the open web.”

Adam Singolda, Founder and CEO at Taboola

Online Moderation

Social media companies such as Twitter and Facebook have had to ramp up efforts in moderating controversial content and disinformation.

Adam Singolda, on CNBC this morning, said in contrast, Taboola is a leader in online moderation. It’s publishing partners are engaged in high quality, premium content. A team reviews every URL it recommends.

Details

Taboola’s listing on the NYSE will be at an implied $2.6 billion valuation via the merger with ION Acquisition Corp.

Taboola expects to have $600 million of cash and cash equivalents on its balance sheet at closing. Transaction is expected to close in Q2 of 2021.

Taboola plans to invest more than $100 million in R&D this year. Investments will include AI, eCommerce, TV and device manufacturers.

Opportunity

Taboola estimates todays highly fragmented advertising market in the open web to be approximately $64 billion in 2020. The company believes their ability to render editorial and paid recommendations natively will create value to users, publishers and advertisers.